I constantly remind and coach my clients about the importance of knowing their numbers. It is fundamentally the most important measure in your business.

Knowing your numbers is the only way to make objective business decisions. If you don’t know your numbers, how can you make informed decisions on what actions you need to take – whether scaling up or cutting back, without the numbers, you’re just guessing.

It is also important to know some of the basic financial terminology and how they relate to your products and services. One of the most regularly asked questions when we cover money mastery in our group coaching sessions, is on the markup vs margin formula – what’s the difference and how to calculate.

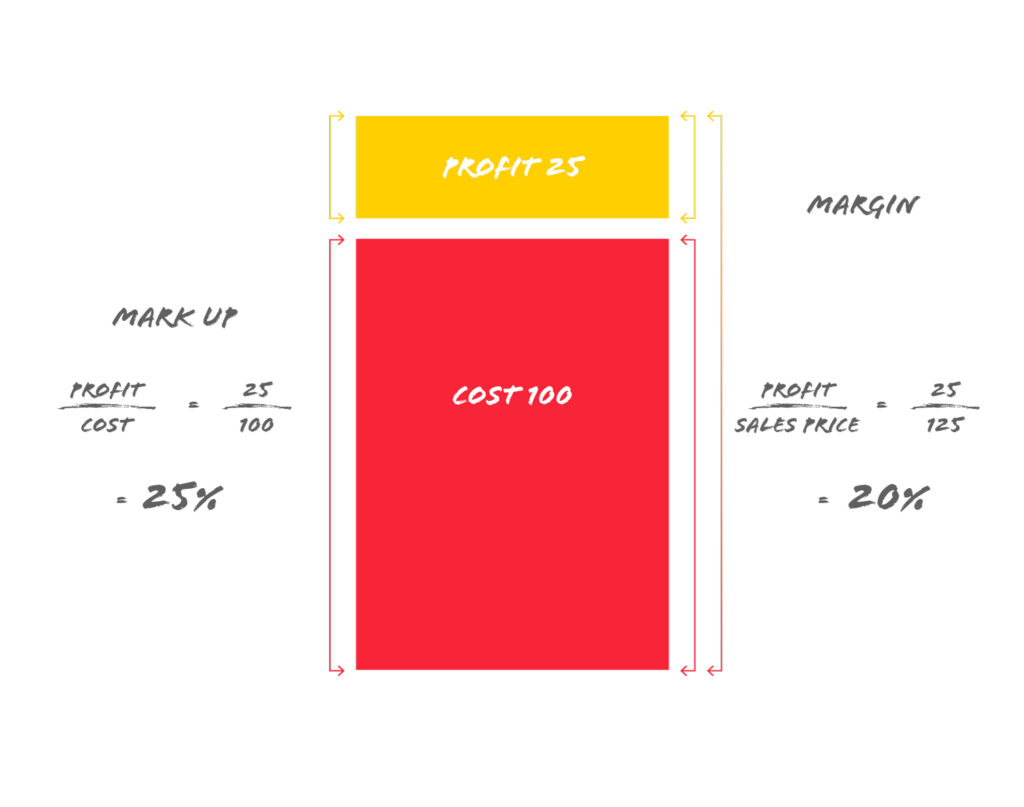

What IS the difference between mark up and margin?

Mark up is the amount added to the price of something. By marking up your products or services from their cost – you are adding profit. It lets you know how much you should be pricing your products at. There are various factors that impact the level of markup including: what you think you can get away with charging, what your competitors are charging and how much demand there is for your product or service. High demand will mean you are likely to be able to add a higher mark up.

Margin is the difference between the net sale and the cost of what you sold. It is the percentage of each and every sale that is profit, that you get to keep. The profit margin gives you a real picture of your potential earnings.

It is a common mistake to think that the markup and margin are the same.

Markup vs Margin formula

How to calculate markup

(Profit ¸ Purchase) x 100%

If you buy for £100 and you sell for £125, you have made a profit of £25 which is a markup of 25% (25 ¸ 100 x 100%)

How to calculate profit margin

(Profit ¸ Sales Price) x 100%

If your profit is £25 and the total cost is £125, the gross profit margin is 20%

(25 ¸ 125 x100%)

It is vital that you not only know the difference between margin and mark up, but how to calculate them because it can mean the difference between make or break your business.

Money mastery is one of the six foundation steps of our coaching programme and is covered in our group and individual coaching sessions.

Book a free discovery call with me and start getting on top of those numbers!